ny paid family leave tax category

New York paid family leave benefits are taxable contributions must be made on after-tax basis. If your employer participates in New York States Paid Family Leave program you need to know the following.

Updated Irs Releases Guidance On Arpa Paid Leave Tax Credits Sequoia

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

. New York Paid Family Leave is insurance that is funded by employees. In 2022 the employee contribution is 0511 of an employees gross wages. Yes NY PFL benefits are considered taxable non-wage income subject.

The benefit amount be included in federal gross income. New York Paid Family Leave premiums will be deducted from each employees after tax wages. Most employees who work in New York State for private employers are eligible to take Paid Family Leave.

They are however reportable as. Tax treatment of family leave contributions and benefits under the New York program. This deduction shows in Box 14 of the W2.

New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. New York Paid Family Leave is insurance that may be funded by employees through payroll deductions. After discussions with the Internal Revenue Service and its review of other legal.

For the last couple of years NYS have being deducting premiums for the Paid Family Leave program. August 29 2017. Benefits paid to.

Now after further review the New York Department of Taxation and. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. Based upon this review and consultation we offer the following guidance.

New York Paid Family Leave is insurance that is funded by employees through payroll deductions. The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee. What category description should I choose for this box 14 entry.

Any benefits you receive under this program are taxable and included in your federal gross income. Your employer will not automatically withhold taxes from these benefits. Paid Family Leave provides eligible employees job-protected paid time off to.

In 2021 the contribution is 0511 of an employees gross wages each pay period. On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice. Paid Family Leave benefits need to be reported on a 1099-Misc as taxable non-wage income.

Employees who reside in another state and work in New York are also eligible for the NY PFL benefit. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. Employees that reside in New York but physically work from another location are not.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. The contribution remains at just over half of one percent of an employees gross wages each pay period.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Fully Funded by Employees. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

The maximum annual contribution for 2022 is. However under the Paid Family Leave law some categories of workers are. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage.

Get Ready For New York Paid Family Leave In 2021 Sequoia

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

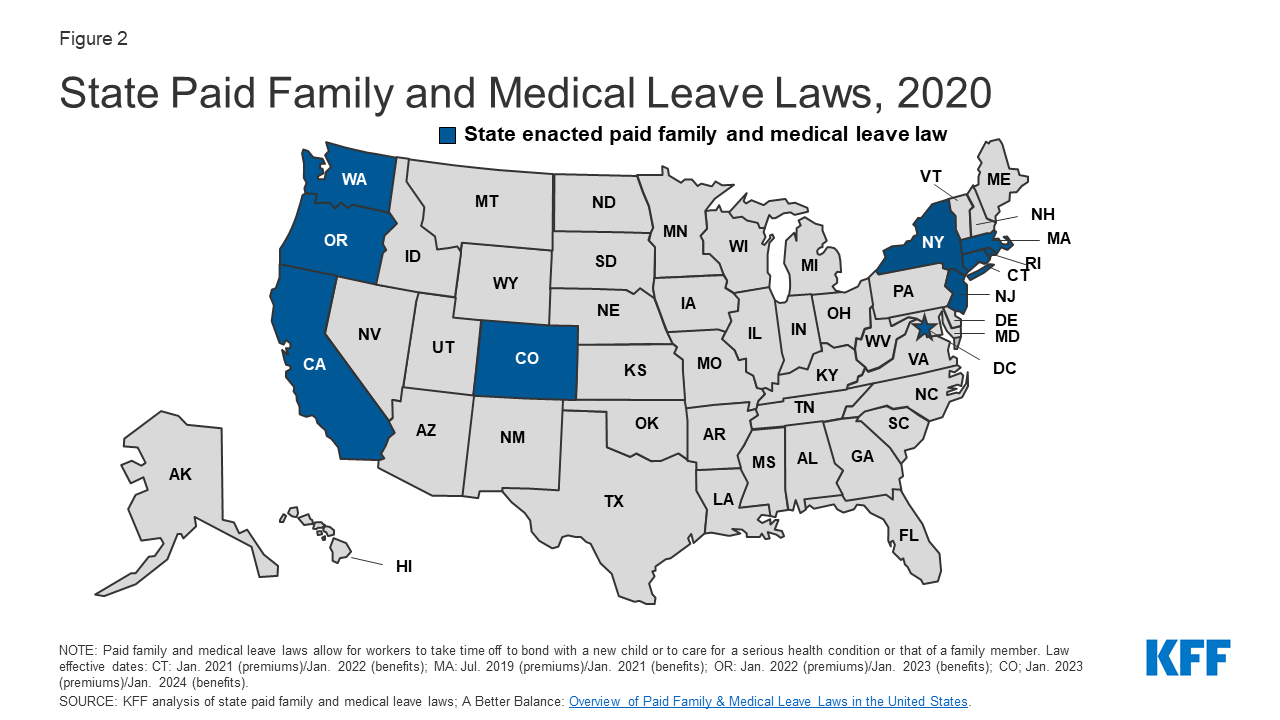

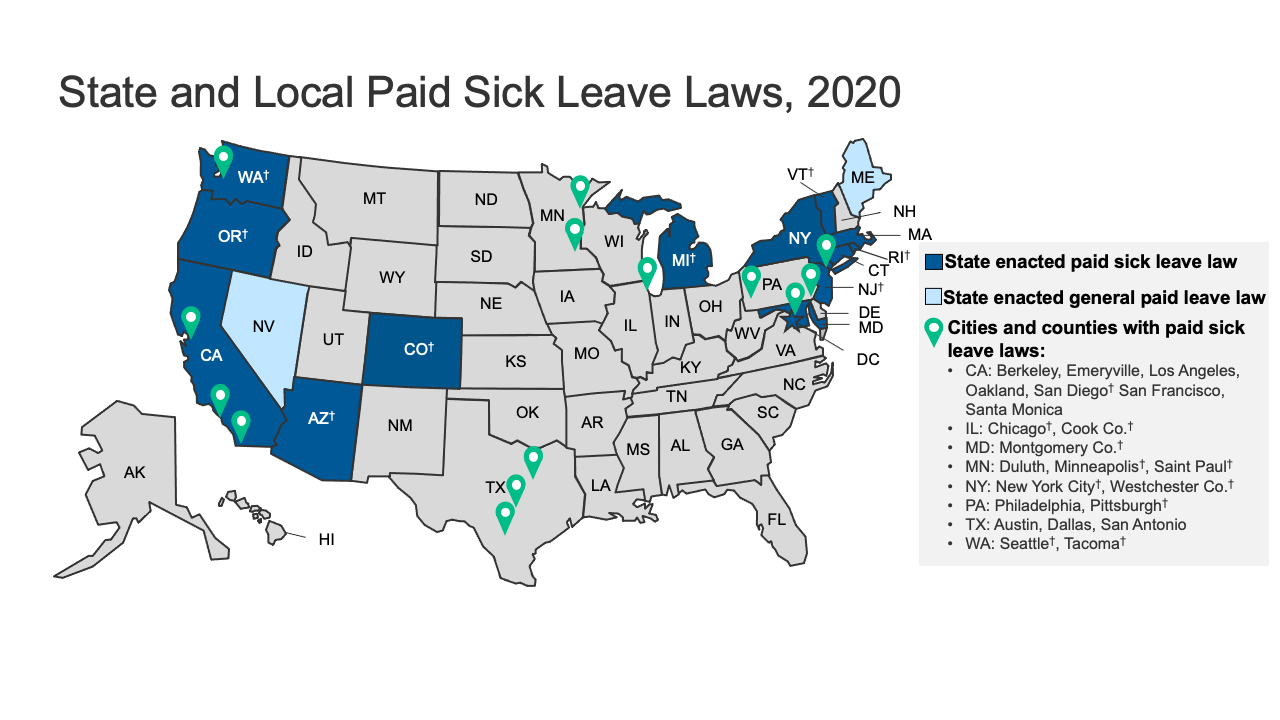

Time Off To Care State Actions On Paid Family Leave

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Paid Family Leave For Family Care Paid Family Leave

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Time Off To Care State Actions On Paid Family Leave

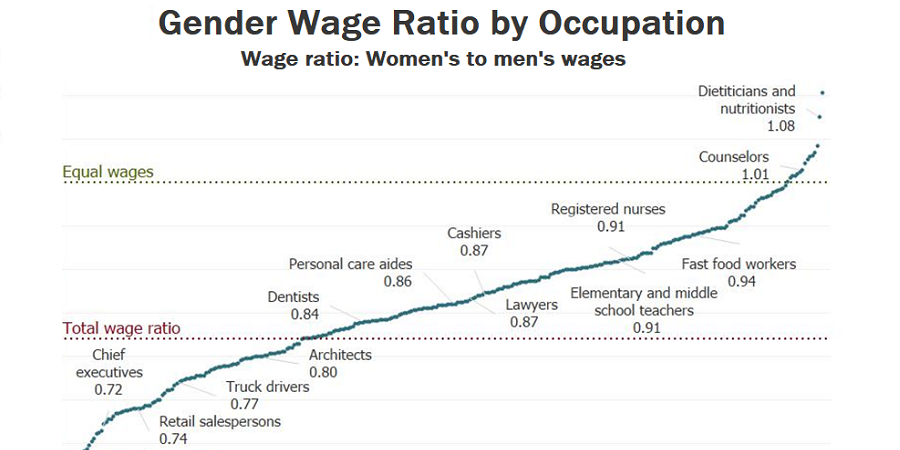

Equal Pay And Pay Transparency Protections U S Department Of Labor

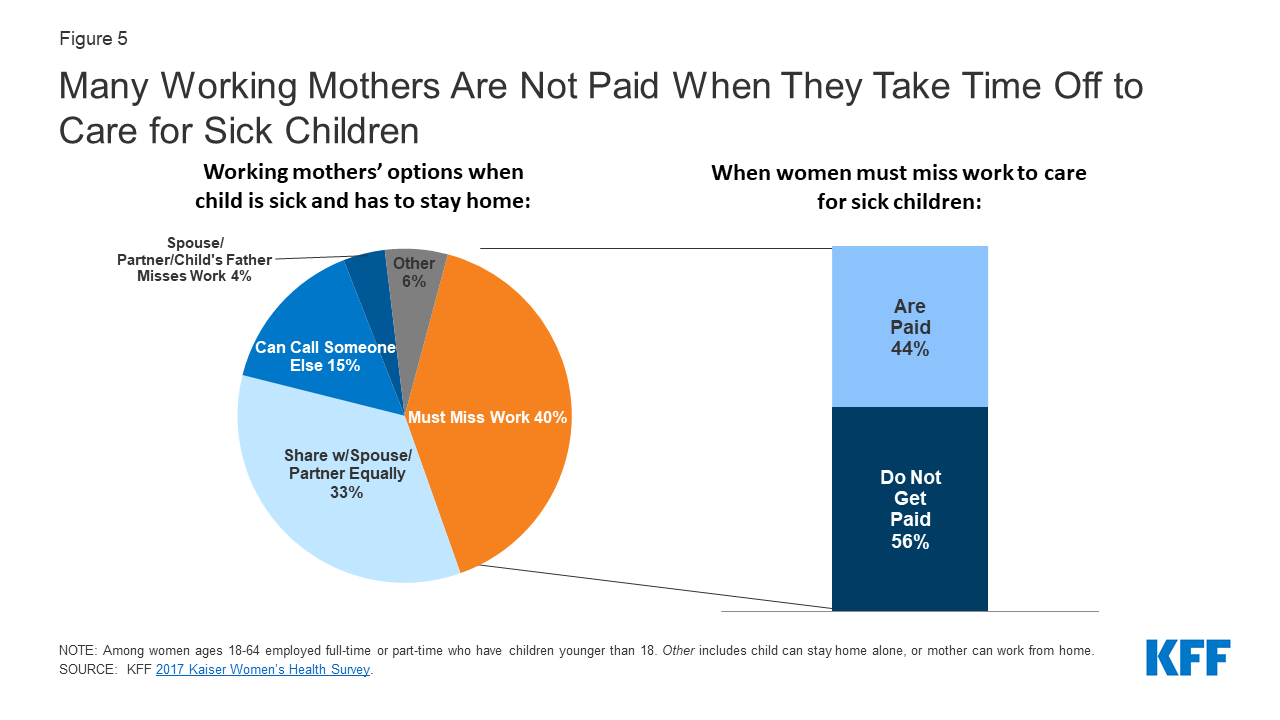

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

The Rising Cost Of Inaction On Work Family Policies Center For American Progress

Get Ready For State Paid Family And Medical Leave In 2022 Sequoia

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

2021 Instructions For Schedule H 2021 Internal Revenue Service

New National Paid Leave Proposals Explained

Paid Family Leave Expands In New York The Cpa Journal

Cost And Deductions Paid Family Leave

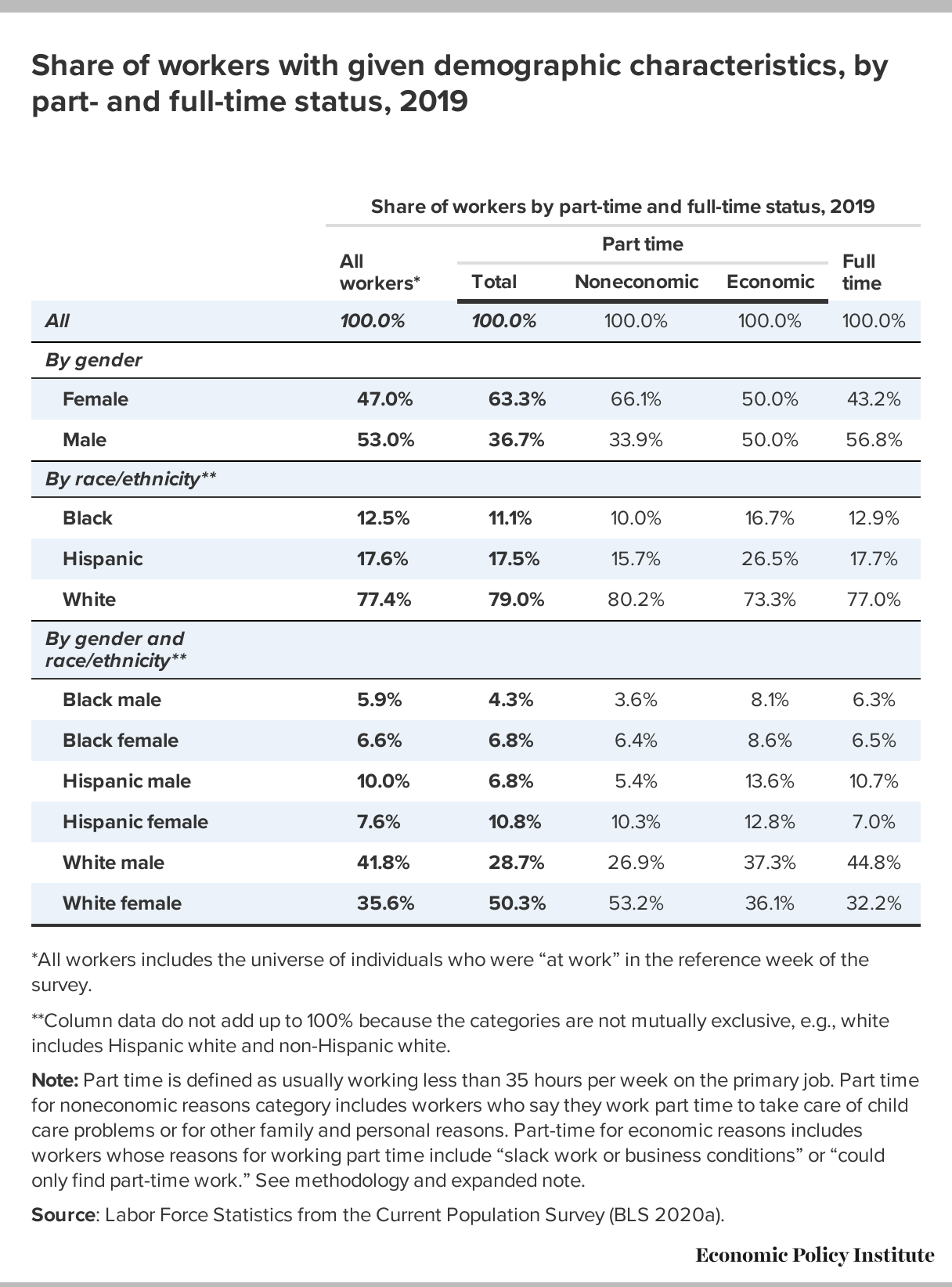

Golden Part Time Workers Pay A Big Time Penalty Hourly Wages And Benefits Penalties For Part Time Work Are Largest For Those Seeking Full Time Jobs And For Men But Affect More Women Economic Policy Institute